Rightsizing the Floor Interest Rate Rules of Sections 7702 and 7702A

By Craig Springfield, Brian King and Robert Fishbein

Taxing Times, March 2021

Recently enacted legislation has modified the interest rate requirements used in the federal tax limits for life insurance contracts so that they better reflect the current, persistently low interest rate environment and dynamically adjust for future changes in market interest rates. This article explores the history of the tax limits, the reason a change was needed, the mechanics of how the rules will work, and compliance considerations with respect to implementing the new testing limits.

Background—Introduction of Life Insurance Tax Testing

Since the early 1980s, life insurance contracts have been subject to various actuarial requirements under federal tax law that limit the premiums and/or cash values of contracts. In establishing these limits, first in 1982 with the enactment of the temporary rule of section 101(f)[1] for flexible premium contracts and then in 1984 with the enactment of the permanent rule of section 7702,[2] Congress intended to accomplish two goals. First, to limit the investment orientation of life insurance as a precondition for receiving the favorable tax treatment traditionally afforded such contracts (that is, tax-free death benefits, tax-deferred growth, and basis-first treatment for withdrawals).[3] And, second, to allow for adequate funding of contracts so that they may provide insurance protection throughout the life of the insured. The advent of universal life insurance and similar designs capable of dialing up or down cash value was an underlying reason for the concern about investment orientation.[4] The goal of allowing adequate lifetime funding was an implicit recognition that if contracts provide significant pure insurance protection, the rules should allow funding in a manner to support holding life insurance for one’s lifetime. In short, the enacted rules were not designed to change the fundamental nature of life insurance, but rather to impose guardrails to ensure that contracts continued to provide material pure life insurance protection and thus prevent them from predominantly functioning as investment vehicles.

Several years after the enactment of section 7702, and in response to the continued marketing of more investment-oriented life insurance products, Congress added a second layer of tax testing that restricted how rapidly life insurance could be funded while still retaining its traditional tax treatment. Section 7702A, defining a “modified endowment contract” (“MEC”), imposed additional actuarial requirements to distinguish more rapidly funded life insurance contracts, and accompanying amendments to section 72(e) accorded MECs less favorable tax treatment.[5] In particular, under the tax rules applicable to MECs, partial withdrawals are treated as receipts of income before any “investment in the contract” is treated as returned, loans are treated as amounts received from the contract, and a 10 percent penalty tax applies to taxable income arising under a contract subject to certain exceptions. However, the MEC rules did not alter the goal that adequate funding should be permitted for life insurance contracts.[6]

The actuarial requirements enforcing the funding limits of sections 7702 and 7702A all require calculations using the greater of a minimum (floor) interest rate and the rate or rates guaranteed under a contract. For contracts issued prior to 2021, and as described in more detail below, the floor interest rates were 4 percent for the guideline level premium (“GLP”), net single premium (“NSP”), and MEC 7-pay premium, and 6 percent for the guideline single premium (“GSP”).[7] These floor interest rates were amended by section 205 of the Consolidated Appropriations Act, 2021, which was signed into law on Dec. 27, 2020 by President Trump (the “Act”).[8] The Act’s changes apply to contracts issued after Dec. 31, 2020, and thus are currently effective for contracts issued on or after Jan. 1, 2021.[9] As discussed below, these changes to the federal tax limits better reflect the interest rate environment that exists as of a contract’s date of issue.

Requirements of Sections 7702 and 7702A

For a contract to qualify as a life insurance contract for federal tax purposes, section 7702 provides that the contract must be life insurance under applicable law, and it must satisfy either (1) the guideline premium limitation (“GPL”) and cash value corridor requirements of section 7702(c) and (d), respectively, or (2) the cash value accumulation test of section 7702(b) (“CVAT”). A contract satisfies the GPL if “premiums paid”[10] never exceed the GPL for the contract.[11] The GPL, in turn, equals the greater of the GSP and the sum of GLPs for the contract. A contract satisfies the CVAT if, by the terms of the contract, its “cash surrender value” as defined in section 7702(f)(2)(A) cannot in any circumstance exceed the NSP for the contract. In each case, section 7702 imposes various computational rules that must be followed for purposes of calculating guideline premiums and NSPs.[12] Section 7702 generally applies to all life insurance contracts issued after Dec. 31, 1984.[13]

As noted, MECs are a subset category of life insurance contracts that receive less beneficial tax treatment than non-MEC life insurance contracts. A contract will be a MEC if it is received in exchange for a MEC or if it fails the so-called 7-pay test.[14] In this regard, a contract fails the 7-pay test if the “amount paid”[15] for the contract exceeds the cumulative 7-pay premiums during the first seven years of the contract or during any subsequent 7-pay test period.[16] Section 7702A generally applies to life insurance contracts entered into on and after June 21, 1988.[17]

Why the Floor Interest Rates Needed to be Changed

For some time now, the floor interest rates required to be used in calculating NSPs and guideline premiums have created challenges for the design and funding of life insurance contracts. The various limitations under sections 7702 and 7702A are based on an assumption that cash values—whether determined on a prospective or retrospective basis—will accumulate reflecting interest, cost of insurance, and certain charges to fund future benefits. If the interest rate assumptions imposed under the tax limits are higher than the actual cash value performance, then cash values will not grow toward a maturity value equaling the face amount. For example, under prior tax law where a universal life insurance contract provided an interest rate guarantee of less than 4 percent interest, the tax limit calculations would have required the use of the higher floor rates (i.e., 4% for the GLP and 7-pay premium and 6% for the GSP). This difference between tax and guaranteed interest rates significantly contributed to the problem of contracts being unable to develop cash values that may carry them through their deemed maturity dates.[18] This problem created by the floor rates has been counterbalanced to some extent by other factors, such as conservatively set mortality guarantees, but as market rates have continued to remain low, funding difficulties have grown.[19]

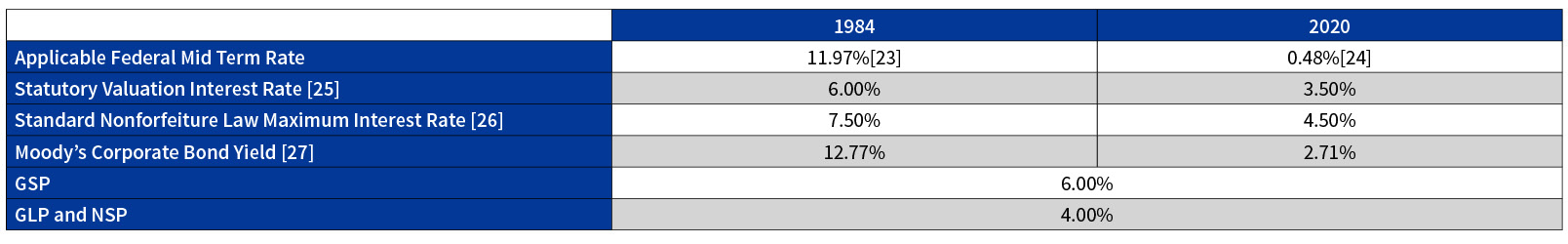

It is noteworthy that the interest rate assumptions imposed by section 7702 did not hamper adequate funding at the time of the statute’s enactment in 1984. At that time the floor rates were significantly less than then-applicable market rates. For example, for July 1984, the average monthly 10-year Treasury bond rate was 13.36 percent, and this rate had not been less than 6 percent since January 1972, and it had not been less than 4 percent since June 1963, i.e., more than 20 years prior to DEFRA’s enactment.[20] Perhaps even more telling, this Treasury rate had been higher than 10 percent since June 1980.[21] Against this backdrop, Congress’ establishment of floor interest rates of 4 percent and 6 percent can be inferred as guardrails that were anticipated to be low enough to permit adequate funding even with significant drops in market rates. For some time now, however, market interest rates have been persistently low. This is reflected, for example, by the fact that the average monthly 10-year Treasury bond rate has been less than 4 percent since July 2008; also, for much of this period it has been less than 3 percent, and recently it has been well less than 2 percent.[22]

The substantial change in rates over time also is reflected by changes in the “applicable federal rates” used for various tax purposes and in the rates used for state law life insurance valuation and nonforfeiture requirements. Table 1 illustrates these changes and includes for comparison the floor rates applicable under section 7702 at the time of the statute’s enactment:

Table 1

Selected Interest Rates

While the floor rates under sections 7702 and 7702A were intended to prevent avoidance of the statute through use of artificially low interest rate guarantees, the unintended outcome of a persistently low interest rate environment has been to prevent adequate funding of life insurance contracts and create product design challenges.

The New Floor Interest Rates

The Act adopts a transition rule for 2021 and, for subsequent years, a more dynamic structure for determining floor interest rates for section 7702, and by cross-reference section 7702A. Under the transition rule, the “insurance interest rate” for life insurance contracts issued in 2021 is 2 percent.[28] This means that for 2021-issued contracts the floor rate for the NSP, GLP and 7-pay premium will be 2 percent, and the floor rate for the GSP will be 4 percent. After 2021, the Act provides for a determination of the floor interest rates by comparing different interest rates, as follows:

- For the CVAT, the legacy floor rate of 4 percent is replaced with the “applicable accumulation test minimum rate,” which generally is the lesser of 4 percent or the “insurance interest rate” at the time the contract is issued.[29] As explained below, for contracts issued in 2022, the applicable accumulation test minimum rate—i.e., the new floor rate for the CVAT—is 2 percent.

- For the GSP, the legacy floor rate of 6 percent is replaced with the “applicable guideline premium minimum rate,” which is the applicable accumulation test minimum rate plus 2 percent.[30] Thus, since the applicable accumulation test minimum rate is 2 percent for contracts issued in 2022, the new floor rate for the GSP for contracts issued in 2022 is 4 percent.

- For the GLP, the legacy floor rate of 4 percent is replaced with the “applicable accumulation test minimum rate,” which as noted is 2 percent for contracts issued in 2022.[31]

- For the MEC 7-pay premium, a floor rate of 4 percent was required under prior law by the computational rule of section 7702A(c)(1)(B), which cross-references the floor interest rate of the CVAT under section 7702(b)(2). As modified by the Act, the floor rate for 7-pay premiums continues to cross-reference the CVAT floor rate, and thus a floor rate of 2 percent must be used for calculating 7-pay premiums for contracts issued in 2022.

While contracts issued in 2021 are subject to the transition rule and those issued in 2022 are subject to the new methodology, as explained below the applicable floor rates for 2022 are the same as those that apply for 2021 under the transition rule. Also, in each of these cases, again we observe that if the contractually guaranteed rate or rates are higher than the floor rate, the higher guaranteed rate or rates must be used.[32] It thus is necessary to examine contract terms closely to see if any interest rate guarantee may be relevant to the calculations. In recent years there has been less need to reflect initial interest rate guarantees in calculations under sections 7702 and 7702A since they typically have been well less than the floor rates. But that may no longer be the case given the new floor rates that will apply to newly issued contracts. The need to reflect contract interest guarantees thus remains an important guardrail of sections 7702 and 7702A. We also note that, for contracts subject to the GPL, the cash value corridor of section 7702(d) was unaffected by the Act and thus continues to require a minimum net amount at risk for such contracts in all circumstances.

How the Floor Interest Rates Will Change

The Act provides that the floor interest rates, once determined, will remain in effect until there is an “adjustment year,” at which time the “insurance interest rate” will be redetermined. Whether this results in a change to the floor interest rates will depend in part on whether the redetermination results in a change to the insurance interest rate. In this regard, “adjustment year” is defined as the calendar year following any calendar year that includes the effective date of a change in the prescribed U.S. valuation interest rate for life insurance with guarantee durations of more than 20 years as defined in the National Association of Insurance Commissioners’ (“NAIC”) Standard Valuation Law.[33] This valuation interest rate has been 3.5 percent since 2013, but it dropped to 3.0 percent for contracts issued on and after Jan. 1, 2021.[34] This means that 2022 will be an “adjustment year.”

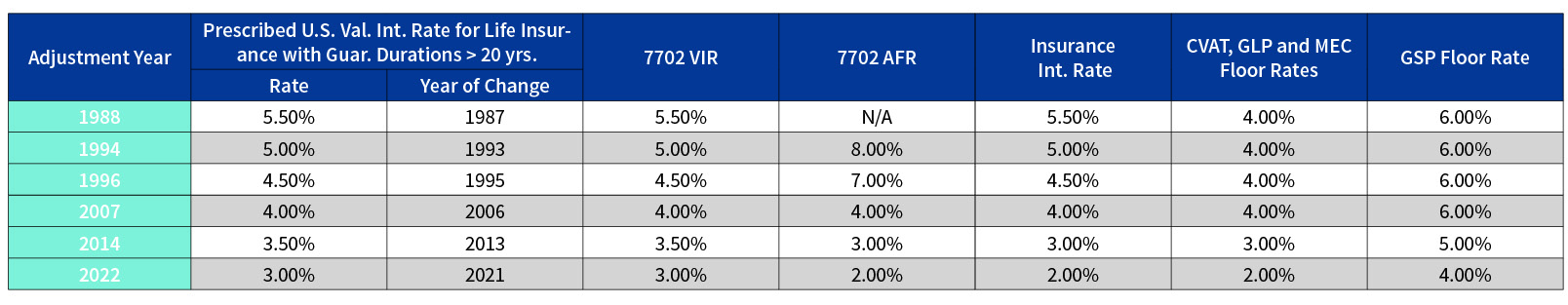

For a calendar year that is an adjustment year, the “insurance interest rate” is defined to be the lesser of (1) the “section 7702 valuation interest rate” (“7702 VIR”) for such calendar year, or (2) the “section 7702 applicable Federal interest rate” (“7702 AFR”) for such calendar year.[35] The 7702 VIR is defined with respect to any adjustment year as the NAIC-prescribed U.S. valuation interest rate for contracts with guaranteed durations longer than 20 years as effective in the calendar year immediately preceding each adjustment year.[36] Since 2022 is an adjustment year and the valuation rate for 2021 is 3.0 percent, the 7702 VIR for contracts issued during 2022 will be 3.0 percent. Also, the 7702 AFR is defined with respect to any adjustment year as the average (rounded to the nearest whole percentage point) of the applicable federal mid-term rates (as defined in section 1274(d) but based on annual compounding) effective as of the beginning of each of the calendar months in the most recent 60-month period ending before the second calendar year prior to such adjustment year.[37] Thus, since 2022 is an adjustment year, the 7702 AFR for contracts issued in 2022 is determined by reference to the 60-month period ending Dec. 31, 2019. For contracts issued in 2022, the 7702 AFR will be 2.0 percent.[38] Thus, the insurance interest rate for contracts issued in 2022 is the lesser of 3.0 percent and 2.0 percent, i.e., 2.0 percent. In short, even though 2022 is an adjustment year, the floor interest rates are unchanged from those provided for under the transition rule for 2021-issued contracts.

The above described mechanics of how the floor interest rates will change, mean that insurers will have around 18 months’ notice before any future change. In the above example, the determination of the floor rates for 2022 were determined based on the 7702 AFR as of the end of 2019 and the 7702 VIR as of June 2020. In short, and unlike the current situation where the Act was promulgated just days before the new rules became effective, insurers will have a reasonable period of time to prepare for future floor rate changes.

While it is uncertain how frequently adjustment years will occur in the future and how the floor rates will change over time, Table 2 illustrates how the floor rates would have developed if the Act’s rules had been included in section 7702 as originally enacted. It is noteworthy that, while the valuation rate has changed and such changes would have resulted in adjustment years, the actual floor rates to be used for testing would only have changed twice, once in 2014 and again in 2022.

Table 2

Floor Rates if the Act’s Changes Had Applied Since 1984

Finally, it is important to note that the new floor rates under sections 7702 and 7702A may go down or up. That is, in a rising interest rate environment the floor rates will adjust up at some point in time, which would mean that less premium and accumulated cash value would be allowed for newly issued contracts. The new adjustment rules are expected to go in both directions, which makes sense in terms of allowing appropriate funding of life insurance for the economic environment in which the contract is issued. The new floor rates will not, however, exceed those that applied when section 7702 was enacted, which also makes sense in that those floor rates were established during a historically high interest rate environment.

The New Tax Limits Allow Appropriate Funding

The rightsizing of the floor interest rates under sections 7702 and 7702A will better allow for appropriate funding of cash value life insurance in a low interest rate environment— whether the contract is subject to premium restrictions or limitations on cash values. Thus, for universal life insurance with guaranteed interest rates of less than 4 percent (which is typically the case now), illustrations of a contract’s guaranteed performance will be able to show continuation of the contract through later durations than has been the case in recent years. There also likely will be less need for such contracts to rely upon no-lapse and similar secondary guarantees or the special rule of section 7702(f)(6) in order to remain in force. (The latter rule is especially cumbersome in that it essentially requires universal life insurance contracts to operate like term life insurance, which becomes very expensive as the insured ages.)

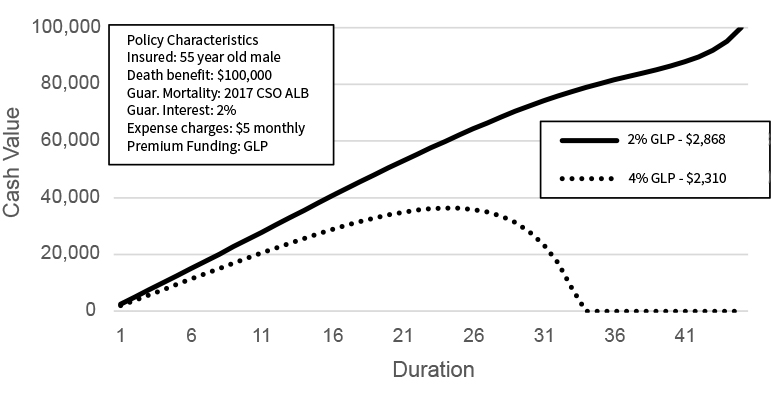

For example, assume a 55-year old male was issued a universal life insurance policy with a death benefit of $100,000, providing a 2 percent interest crediting rate guarantee on the policy’s account value. Under prior law, the GLP for the policy would have been $2,310.[39] However, assuming the policy performs at its guarantees, payment of the GLP would only fund the contract’s cash value to duration 34, when the insured is 88 years old, providing the policyholder with a difficult choice of potentially having to terminate coverage at that time or continue to keep the contract in force by paying the annual insurance cost as provided for under section 7702(f)(6). Note that a policy will, based on current assumptions, outperform what is shown here. Beginning at attained age 88, the annual funding cost under section 7702(f)(6) assuming cost of insurance is based on policy guarantees would be approximately $16,000, increasing to over $33,000 at age 95. These costs are well in excess of the annual funding that may have been anticipated based on the GLP, likely rendering the policy unaffordable for most policyholders (see Figure 1).

Figure 1

Cash Value Funding under Policy Guarantees

If the same policy were issued in 2021, the Act now allows for the GLP to be calculated with a floor rate of 2 percent, increasing the GLP to $2,868. The higher GLP is necessary to offset lower interest credits on cash value, allowing for funding of cash value based on policy guarantees that maintains the contract in force to age 100.

For whole life insurance, the new methodology for determining the CVAT floor rate generally should allow tabular cash values required by the standard nonforfeiture law to be better supported by investment returns insurers earn on premiums received from contracts. The new rules also should offer more design flexibility for such contracts. A further consideration for whole life insurance has been the need to comply with both the CVAT (which establishes a ceiling on cash values) and state nonforfeiture laws (which establish minimum cash values). In this regard, state nonforfeiture law generally requires minimum cash values to be based on a rate that is no higher than 125 percent of the valuation rate, rounded to the nearest quarter percent.[40] The dynamic nature of the interest rate mechanism in the standard nonforfeiture law allows for minimum cash values to increase or decrease based on underlying movements in interest rates.

To address concerns created by declining interest rates, the NAIC amended the nonforfeiture law in 2014, putting a 4 percent floor on the interest used to determine minimum cash values to ensure that the nonforfeiture law interest rate did not require cash values that would exceed those permitted under the CVAT. A more recent amendment to the Valuation Manual modified this provision, presumably in anticipation of possible amendments to section 7702, replacing the hard-coded 4 percent floor rate for computing minimum cash values with “the applicable interest rate prescribed to meet the definition of life insurance in the Cash Value Accumulation Test under Section 7702 (Life Insurance Contract Defined) of the U.S. Internal Revenue Code.”[41] With both the changes made to section 7702 and the updated language in Valuation Manual, minimum nonforfeiture cash values must now be determined based on interest at the higher of the result of this 125 percent formulation and the CVAT floor rate. The 125 percent formulation is expected to reduce the nonforfeiture rate to 3.75 percent for contracts issued on and after Jan. 1, 2022.[42]

Compliance Considerations—Section 7702

The increase in funding limits under the Act generally means that a contract issued in 2021 that satisfies the prior-law section 7702 requirements similarly should comply with the new section 7702 requirements. For CVAT contracts this is the case since the death benefit provided under such contracts based on a 4 percent NSP should be sufficient to ensure compliance with the CVAT where the applicable rate under the new rules is lower. For GPL contracts, however, the compliance posture is more complicated. The pre-Act rules should prevent the receipt of premiums exceeding the GPL, but there may be situations where this is not the case. For example, problems could arise where reductions in benefits occur that require an attained-age decrement adjustment to the GSP and GLP under section 7702(f)(7)(A), or in situations involving excess premiums returned pursuant to the 60-day rule of section 7702(f)(1)(B) or disregarded pursuant to the special rule of section 7702(f)(6) for underfunded contracts. Given these possible circumstances, issuers of such contracts will need either to implement the new GPL rules or get comfortable that application of the old rules, together with any necessary new control procedures, is sufficient for tax compliance.[43]

Assuming the new limits are utilized for all 2021-issued contracts, insurers may need to modify existing compliance controls to properly monitor the new limits until their administrative systems are reprogrammed to support the calculation of the new limits. For example, rather than testing premium as it enters a contract, insurers may utilize the 60-day rule of section 7702(f)(1)(B) to prevent a failure. As the new rules apply only to contracts issued on and after Jan. 1, 2021, this means that insurers have at least until 60 days into 2022 to implement the new GPL rules and take any needed corrective action.

In most situations, we expect that the Act’s changes will not necessitate the refiling of contract forms in order to comply with section 7702, but refiling may be necessary under state law depending on the particular facts. Also, even if refiling is unnecessary to remain tax compliant, insurers may need to refile forms to take advantage of the higher funding limits allowed by the Act. For example, if an existing whole life insurance contract form reflects a 4 percent interest rate guarantee, the insurer generally would need to refile the form reflecting a lower nonforfeiture interest rate guarantee (of at least 2 percent for contracts designed to satisfy the CVAT), likely accompanied by a new actuarial memorandum. Also, as noted above, the Valuation Manual’s rules for determining the nonforfeiture interest rate under the Standard Nonforfeiture Law have been revised to remove the 4 percent floor rate that previously had been incorporated to prevent a conflict with the CVAT.[44] Thus, refiling of whole life insurance forms will eventually be needed due to this change.

Compliance Considerations—Section 7702A

In the case of contracts with interest rate guarantees of less than 4 percent, proper application of section 7702A may be one of the most immediate and pressing challenges arising from the Act’s changes. Pending updates to systems and procedures, use of the prior-law 7-pay limit for newly issued contracts could result in the identification of a contract as a MEC when in fact it is not. This, in turn, could cause an insurer to tax report distributions from the contract on Form 1099-R incorrectly, which may subject the insurer to tax reporting penalties (and unhappy policyholders). Due to this risk, insurers should implement the new section 7702A limits for post-2020 contracts to allow for proper identification of MECs and tax reporting of distributions. For distributions during 2021 (including loans from MECs), Form 1099-Rs will need to be sent in early 2022.

Other stopgap measures also may be helpful during the process of implementing the new section 7702A rules. If an owner desires non-MEC treatment, perhaps they should be encouraged pending implementation of the new MEC rules to pay premiums at a level less than the prior-law 7-pay limit. This might reduce the number of contracts for which there is uncertainty with respect to MEC status. If an owner chooses to fund in a manner that exceeds the prior-law MEC limits, the insurer may use the 60-day rule of section 7702A(e)(1)(B) to reverse any inadvertent MEC arising under the new rules if excess premiums are returned to the owner with interest within 60 days after the end of the contract year. In addition, while of limited utility as a general approach, precise manual calculations of 7-pay premiums based on the new rules might be employed in limited circumstances, e.g., where a contract is issued in 2021 but then later in the year is exchanged for a contract issued by another carrier and the new carrier asks whether the exchanged contract was a MEC.

Insurers also should consider other potential implications of the new rules for section 7702A, including for the application of the material change rules under section 7702A(c)(3), the so-called necessary premium test,[45] and the reduction-in-benefit rules of section 7702A(c)(2) and (6).

Additional Compliance Considerations

The changes brought about by the Act will require insurance companies to develop a plan to address how the Act’s changes will be implemented for policies issued in 2021, 2022 and beyond. This will include assessing the need to update existing products, develop new products, and conform policyholder administration systems (and other related systems and procedures) to these new requirements. While the previous discussion focused on qualification considerations under both sections 7702 and 7702A, there are other practical considerations that companies should be thinking about.

For example, companies may determine that products need to be repriced or reconfigured to align internal pricing objectives because of the new limits, even if the Act’s changes do not necessitate refiling of products with state insurance departments. For example, target premiums, face amount bandings, and commission levels may have been set in relation to the old limits. Also, because the new limits allow policies to provide lower death benefits for the same premium, some adjustment to products or pricing parameters may be needed to achieve profitability targets. Updates to illustrations systems, policyholder administration systems, and marketing and sales literature probably will be needed, too. Because the Act’s changes have a direct impact on 2021 sales, as well as the profitability of those sales, repricing considerations may become more of a short-term priority for companies as they think through their implementation planning.

In addition to the section 7702 and 7702A technical compliance considerations described above, insurers face a broader question as to what to do for contracts now being issued. It will, no doubt, take some time to update systems and procedures—more certainly than the five days between the Act’s enactment on Dec. 27, 2020 and the Jan. 1, 2021 effective date. This has a twofold impact. The first relates to the need to implement operational procedures to address newly issued contracts prior to the completion of conforming changes to policyholder administrative systems. In this regard, insurers should consider what notice to provide to prospective and new policyholders to apprise them of the change in law and other related information, e.g., that updated information may need to be provided later. Insurers also should ascertain what documentation is affected. For example, tax information relating to the contract sometimes is provided in policy specifications, illustrations, annual reports, and perhaps also in other ways. Further, insurers should consider how the Act’s changes affect their notice and consent procedures with respect to whether a contract is a MEC, e.g., when and in what manner will companies insist upon consent to MEC status during the implementation process. The second relates to how qualification testing will be performed for policies issued prior to system changes becoming effective that support the new requirements. Will policies continue to be administered under prior law limits, but with additional operational procedures in place to support the Act’s new rules? Such an approach may be feasible in some contexts, such as for the GPL, but may be challenging in others, such as for section 7702A. Will a temporary procedure be utilized to address tax compliance, such as use of the statutes’ 60-day rules and/or manual calculations for some transactions, with an intention of applying the new limits retroactively once systems are updated? Companies will need to evaluate these considerations as they develop their implementation plans for dealing with the Act’s changes.

Finally, as companies consider implementation of these changes, they also should consider how future changes in the floor rates will be handled. Unlike transitions in CSO tables or nonforfeiture law interest rates, there will be no transition period of a year or more during which either the old or new rules may be used. Rather, changes in the floor rates in response to an adjustment year will be point in time, with contracts issued before the transition date being subject to the old rules and those issued on and after that date being subject to the new rules.[46] Company procedures will need to carefully control the assignment of issue dates to contracts during such transitions to ensure that foot-fault errors do not arise.

The Effective Date of the New Rules

As noted, the changes to section 7702, and by cross-reference to section 7702A, apply to contracts issued after Dec. 31, 2020.[47] In this respect, the effective date rule for the Act’s amendments mirrors the DEFRA effective date rule for section 7702. Thus, it arguably is relevant that a contract’s “issue date” for purposes of applying the effective date of section 7702 was described as “generally the date on the policy assigned by the insurance company, which is on or after the date the application was signed.”[48] The legislative history of section 7702 also discussed whether certain changes to a contract would cause it to be newly issued for purposes of applying the effective date.[49] Of course, the tax policy considerations associated with the DEFRA and Act effective date rules differ in that section 7702 imposed new restrictions whereas the Act refines the statute’s actuarial calculations to reflect changes in the interest rate environment that, at least at present, loosen the prior limits.[50] Given that the policyholder’s incentives are different here, consideration should be given as to how to apply these rules.

Concluding Thoughts

For sections 7702 and 7702A to operate appropriately, it is critical to give due consideration to both purposes of the statutes—of restricting investment orientation while also allowing for adequate funding. The low interest rate environment, which now has persisted more than a decade, has created substantial challenges for insurers with respect to this second consideration. Fortunately, the Act’s changes have taken a substantial stride towards rectifying this problem, in a thoughtful and dynamic manner which should help prevent similar concerns from arising in the future.

The views reflected in this article are those of the authors and do not necessarily reflect the views of Davis & Harman LLP, Ernst & Young LLP or other members of the global EY organization, Prudential Financial, Inc. or the Society of Actuaries.

Craig Springfield is a partner with Davis & Harman LLP and may be reached at

crspringfield@davis-harman.com.

Brian G. King, FSA, MAAA, is a managing director with Ernst & Young LLP. He can be reached at brian.king3@ey.com.

Robert A. Fishbein is a Vice-President and Corporate Counsel (Tax) with Prudential Financial, Inc. He can be reached at robert.fishbein@prudential.com.