Accounting for Ceded Reinsurance Under LDTI—Constraints and Existing Business

By Steve Malerich and Jack Liu

The Financial Reporter, May 2024

In the July 2022 issue of The Financial Reporter, we presented a framework for measuring the reinsured portion of losses recognized from constraints on the traditional liability for future policy benefits (“Ceded Constraints”).[1] The framework can be applied to reinsurance of a previously existing block of business as described in the July 2021 issue of The Financial Reporter (“Ceded Existing Business”).[2] The combination, however, presents a unique challenge when ceding a cohort that is already deficient.

Objectives

As in previous articles, we evaluate approaches to accounting for ceded reinsurance under three objectives—compliance, performance and simplicity—as introduced in the November 2020 issue of The Financial Reporter (“A Fresh Look”).[3]

Compliance relates to formal guidance, including authoritative standards of the Financial Accounting Standards Board and non-authoritative guidance published by the American Institute of Certified Public Accountants (AICPA).

Performance includes consistency with the protection provided by the reinsurance.

Simplicity seeks one approach that can be applied to all long-duration reinsurance for all products subject to the same underlying liability measurement standards.

Basic Framework

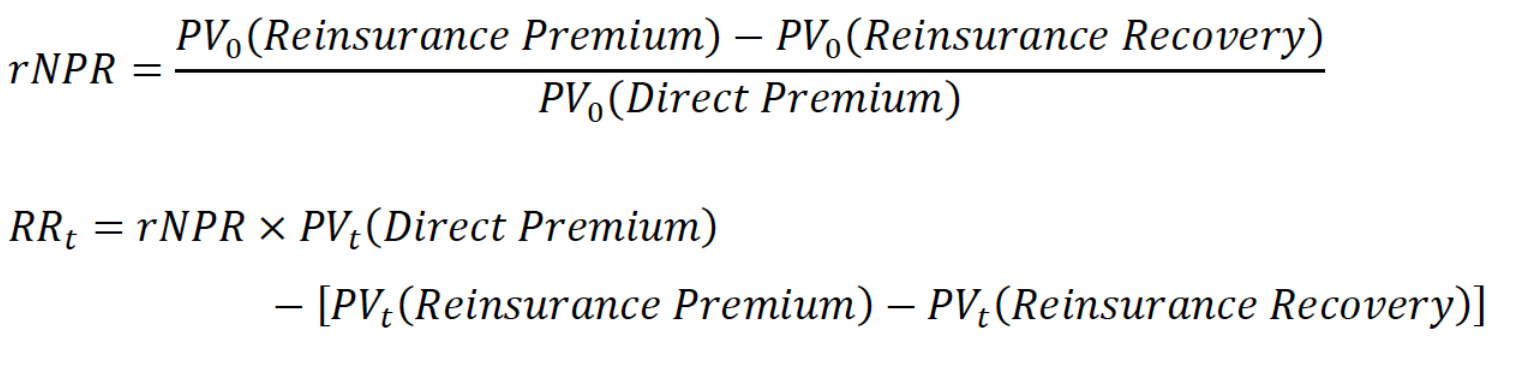

When accounting for reinsurance of contracts subject to net premium reserve requirements, the simplest approach is “net cost” as described in the February 2021 issue of The Financial Reporter (“Precedent”)[4]—also known as the “integrated” approach. This method, consistent with GAAP’s “right of setoff” (ASC 210-20-45-1 and 45-2), nets reinsurance cash flows into a single, net reinsurance recoverable (RR) asset or liability.

According to the AICPA, “for contracts that reinsure existing (in force) traditional and limited payment long-duration insurance contracts, the reinsurance recoverable and the cost of reinsurance should be measured using the liabilities for future policy benefits of the underlying direct contracts reinsured, as remeasured using the … discount rate assumption at the date the reinsurance contract is recognized. …”[5]

A complication arises when the underlying liability (LFPB) at inception of the reinsurance includes an adjustment for capping the net premium ratio or flooring of the liability. In this event, “the insurer should not recognize a gain at inception of a reinsurance transaction. …”[6] Still, if the framework is to work in subsequent measurements, it must be applied to reinsurance recoverable at its inception. Doing so does not create a conflict with the guidance as long as the initial cost of reinsurance (CoR) – “The difference, if any, between amounts paid for a reinsurance contract and the amount of the liabilities for policy benefits relating to the underlying reinsured contracts …” (ASC 944-605-30-4) is calculated after applying constraints.

Application

In this article, the framework is illustrated for a seven-year, level premium term insurance contract. (To capture longer-term effects, mortality and lapse rates are adjusted to simulate the aging of a 20-year term contract.) The original discount rate is 2%. Premiums occur at the beginning of each year, benefits at the end of the year. The cohort is coinsured 100% as of the beginning of its fourth year, after an adverse assumption change, and with a current discount rate of 4%. (For the illustration, cash flows are in whole dollars, but intermediate calculations are rounded only in print.) The attributed retrospective approach, from “Ceded Existing Business,” is used.

Preparing for Initial Measurements—Underlying Contract Liability at Inception of Reinsurance

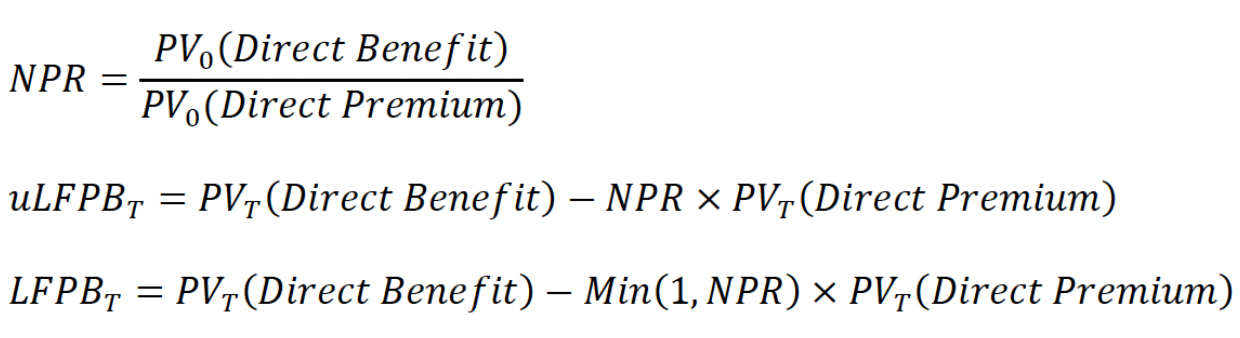

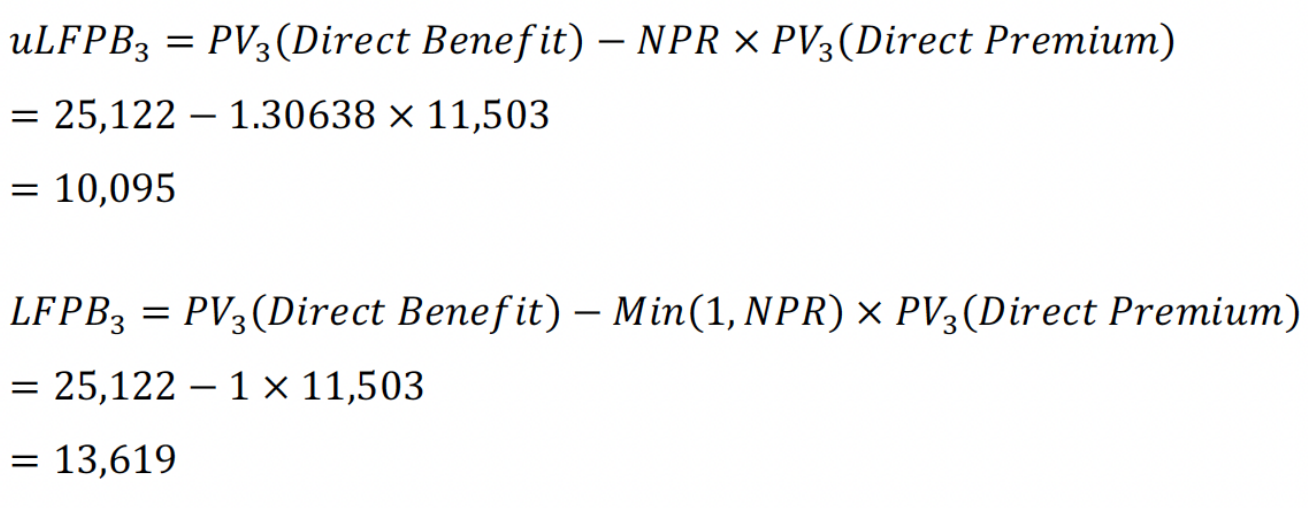

To apply the framework at inception (time T) of the reinsurance, we need to know the underlying liability before constraint (uLFPB) and after (LFPB).

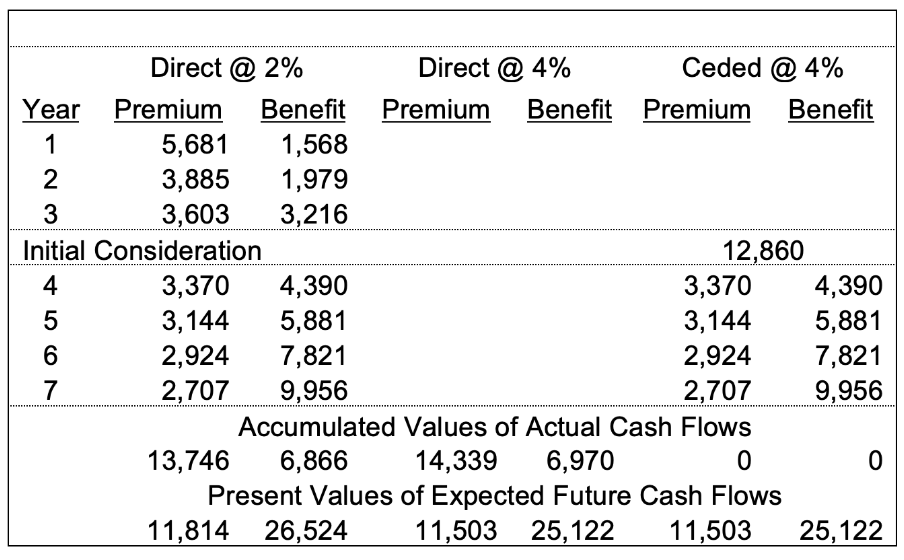

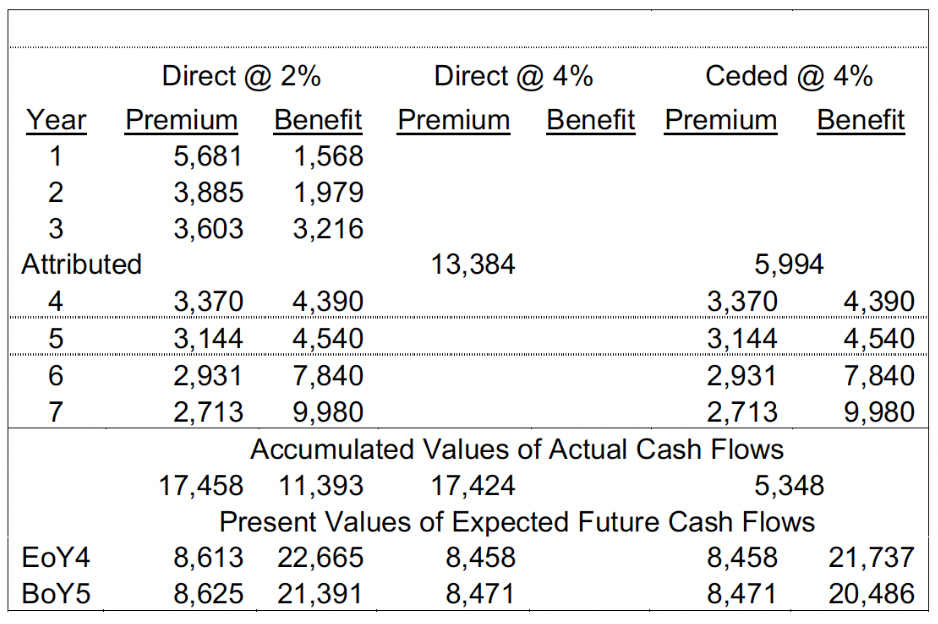

To illustrate, Table 1 shows the cash flow history prior to inception of the reinsurance, expected cash flows thereafter, and present values of the cash flows as of inception of the reinsurance and at applicable discount rates.

Table 1

Cash Flows and Present Values

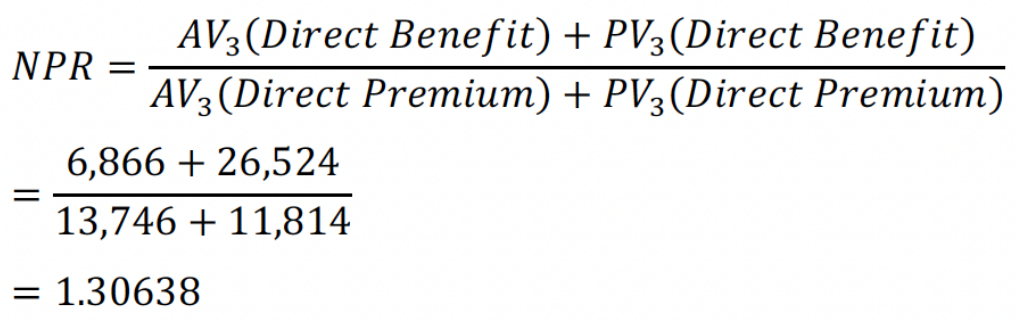

Applying the original (2%) discount rate to actual and expected cash flows, we derive the current net premium ratio of the underlying contracts—before any constraints.

Following the AICPA guidance, the initial RR should be based on the LFPB as remeasured using the current (4%) discount rate and capping the net premium ratio. But, for the “Ceded Constraints” framework to be effective, we also need uLFPB.

Initial Measurement—Reinsurance Recoverable

The reinsurance recoverable, before constraint (uRR) and after (RR), is equal to the quota share (Q) of the corresponding liability.

Initial Measurement—Implied History

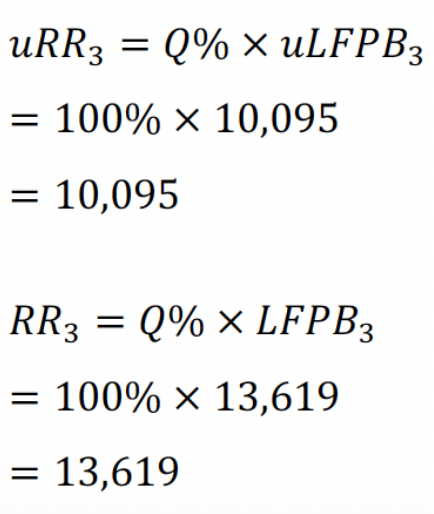

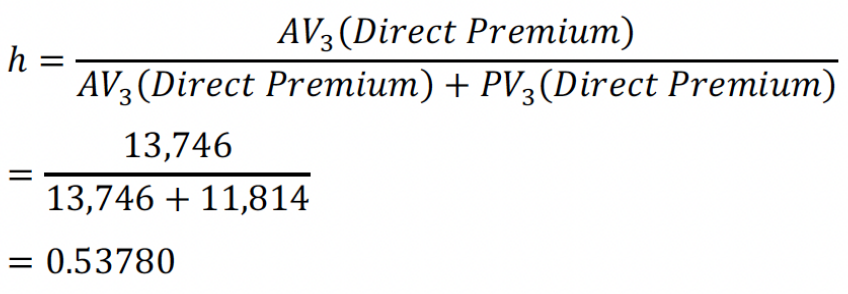

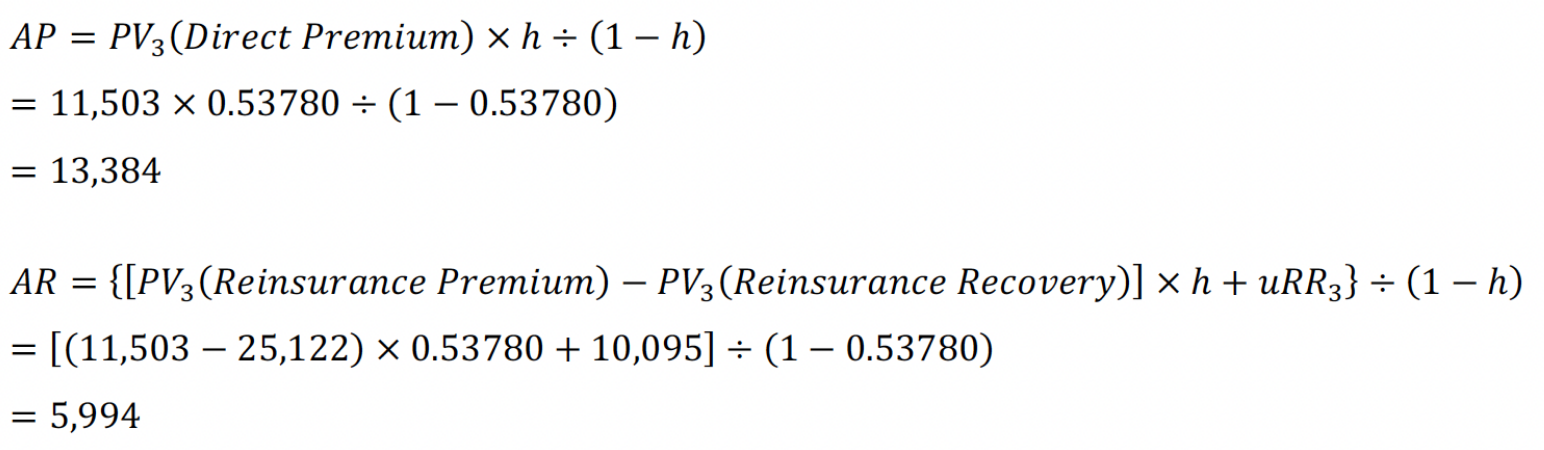

The attributed retrospective approach begins with the historical ratio (h) of the underlying revenue stream, as of the reinsurance date, discounted at the original discount rate.

As described in “Ceded Existing Business,” the approach looks through the initial RR balance to its implied history—attributed premium (AP) and attributed recovery (AR)—measured as of the treaty date using the then current (4%) discount rate.

Checking Initial Measurements

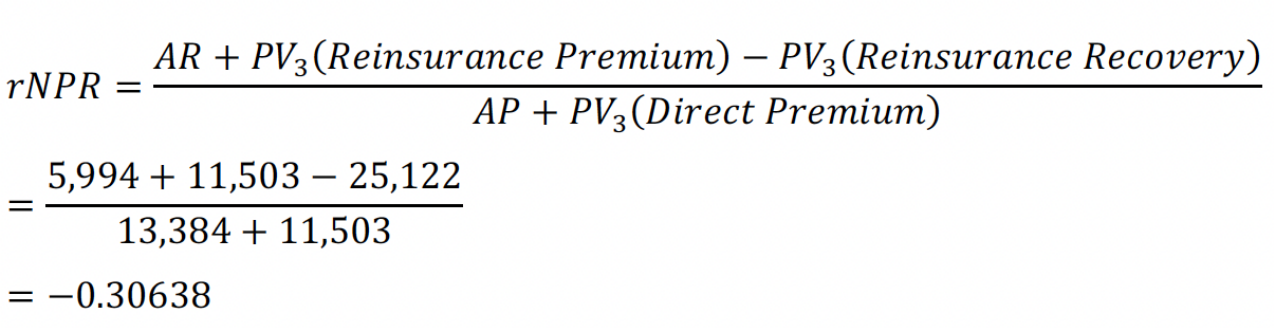

Treating implied history as actual cash flows at inception of the reinsurance, together with current present values, we calculate an initial recoverable net premium ratio (rNPR).

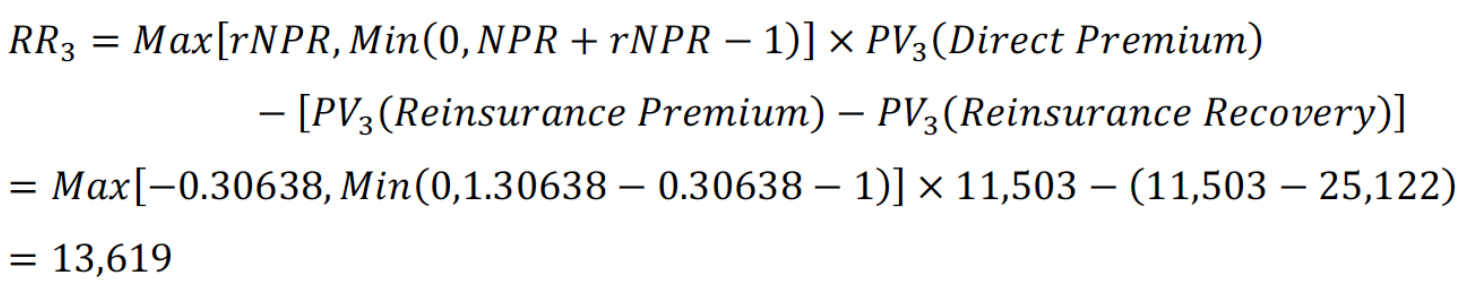

We then recalculate RR by applying this net premium ratio, together with the present values of expected cash flows, in the net cost recoverable formula of “Precedent” adjusted for the “Ceded Constraints” framework.

Following the AICPA guidance, this RR should equal the quota share of the current LFPB. Indeed, the earlier calculations found this to be 13,619.

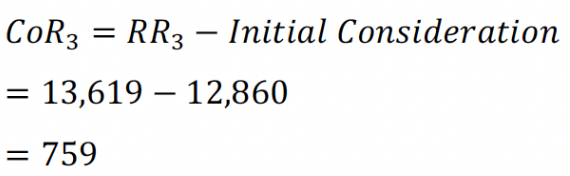

Initial Measurement—Cost of Reinsurance

Satisfied that the initial RR complies with AICPA guidance, we proceed with calculation of an initial CoR liability. To avoid reporting a gain at inception of the reinsurance, CoRT is the difference between RRT and the initial consideration paid for the reinsurance.

As a cost of long-duration reinsurance, this is to be amortized over the life of the underlying contracts (ASC 944-605-35-14) using consistent assumptions (ASC 944-605-35-15) and is not subject to the LFPB constraints. Otherwise, GAAP does not specify the manner of amortizing CoR and its amortization is beyond the scope of this article.

Subsequent Measurements

When experience deviates from expected, ASC 944-40-35-6 requires an update of the NPR and the LFPB. ASC 944-40-35-6A(a)(1) requires measurement of that change for separate presentation in the income statement. According to the AICPA, rNPR and RR should be similarly updated.[7]

To isolate the effects of an experience variance in our example, we step forward one year with actual experience equal to expected and then see a favorable claim variance in the following year. Table 2 shows the updated cash flows and present values. To illustrate the effects of attributed retrospective remeasurement on RR, the current (4%) accumulated values are derived from attributed and subsequent cash flows.

Table 2

Cash Flows and Present Values

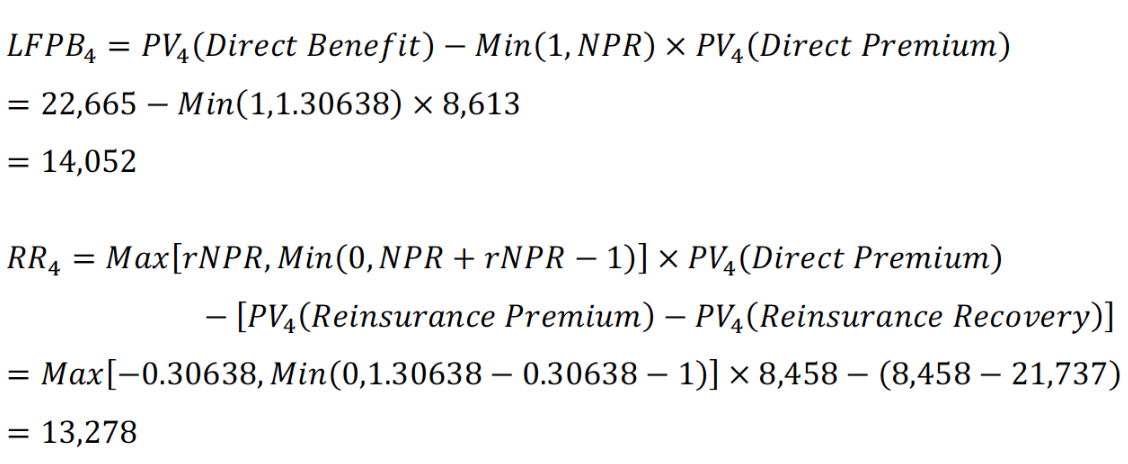

Before moving to year five, we calculate LFPB and RR at the end of year four using present values of Table 1’s remaining cash flows (shown as EoY4 in Table 2) at their respective locked-in discount rates and unchanged net premium ratios.

Remeasurement for an Experience Variance

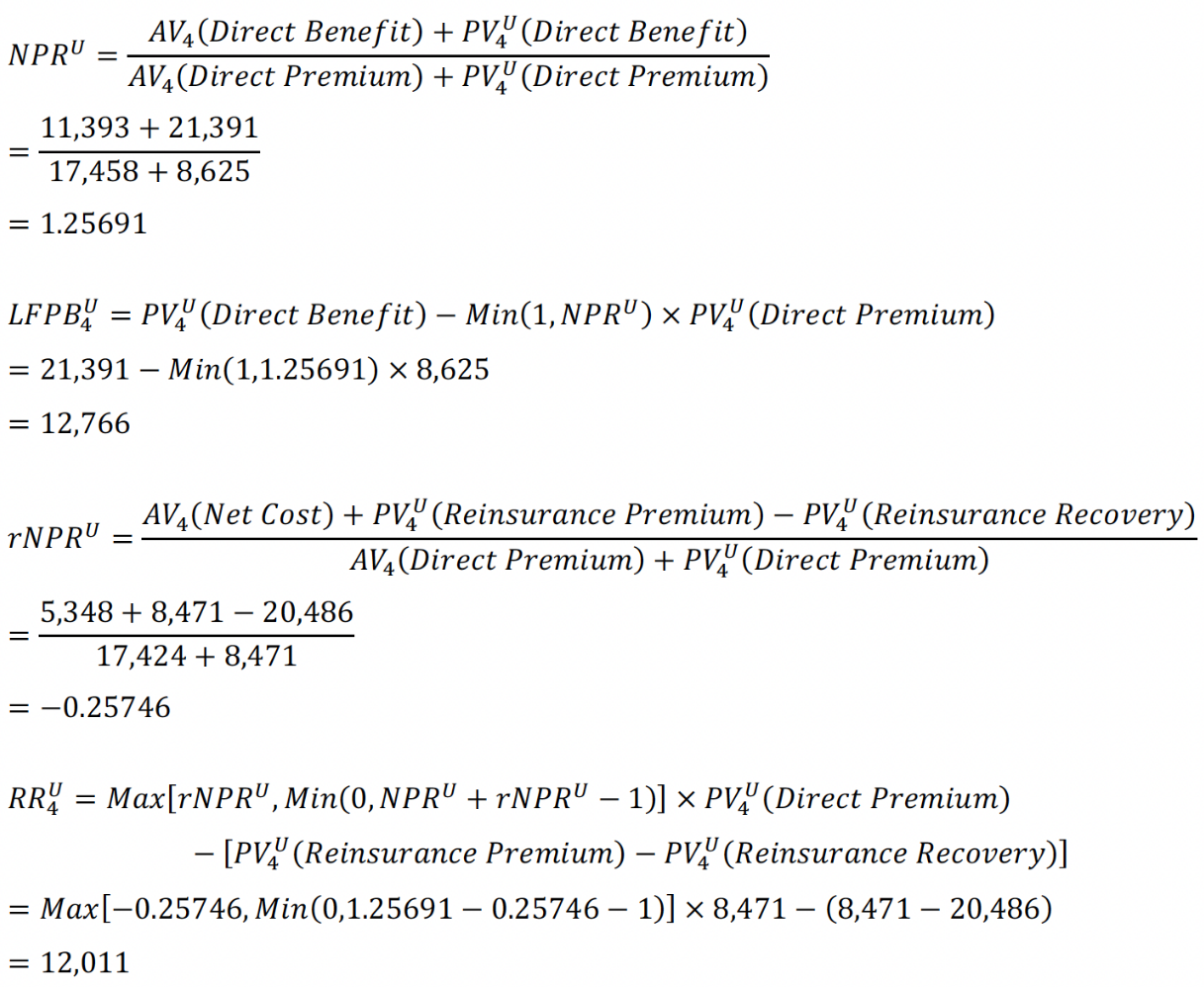

Claims are lower than expected in year five, with a secondary effect on the amount remaining in force. Present values are updated as of the beginning of the year to include actual and updated expected cash flows. The accumulations of prior cash flows are unchanged from the end of year four. With discounting at the original rate for LFPB and the reinsurance rate for RR:

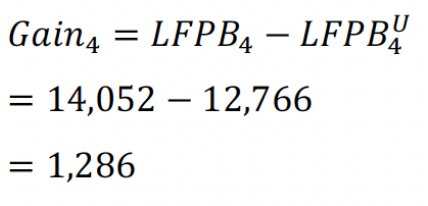

As described in ASC 944-40-35-6A(a)(1), the direct remeasurement gain is the difference between the carrying amount of the liability and the updated liability.

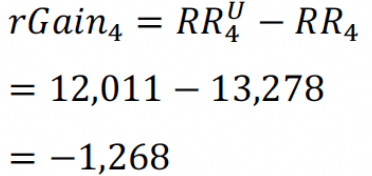

The reinsurance remeasurement gain is the difference between the updated asset and the carrying amount of the asset.

Disclosure Attribution

To disclose “quantitative information about adverse development … because of net premiums exceeding gross premiums” (ASC 944-40-50-6(d)), the remeasurement gains can be split into amounts due to changes in net premium ratios and amounts due to capping. Since the cap was already applied in year four, this split requires three parts; (a) effects of removing the prior cap, (b) updating the net premium ratios, and (c) imposing the cap on the updated ratios. Parts (a) and (c), together, represent the current period gain or loss from capping.

In “Ceded Constraints” we described the cost of capping the net premium ratio as a type 1 loss. When effects of prior capping are increasing or decreasing, as in this article, we present it as a type 1 gain, with negative values indicating a loss. For comparable notation, we’ll call the effect of updating the net premium ratio (without constraints) as a type 0 gain.

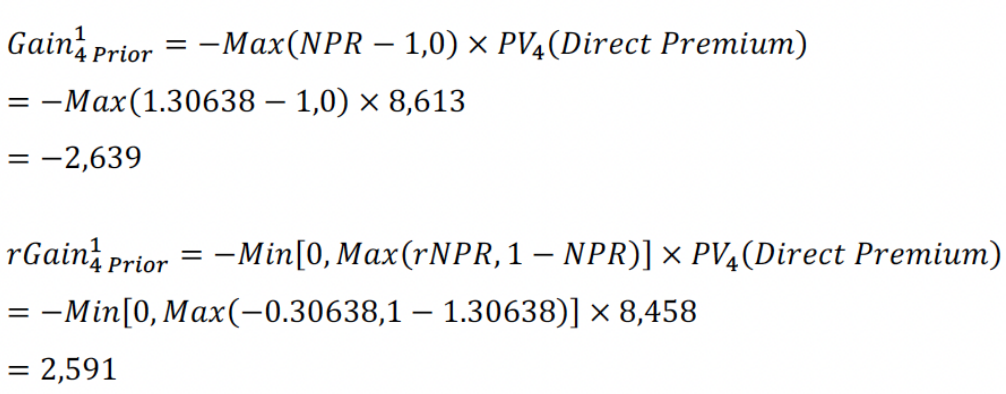

- Effect of the prior cap:

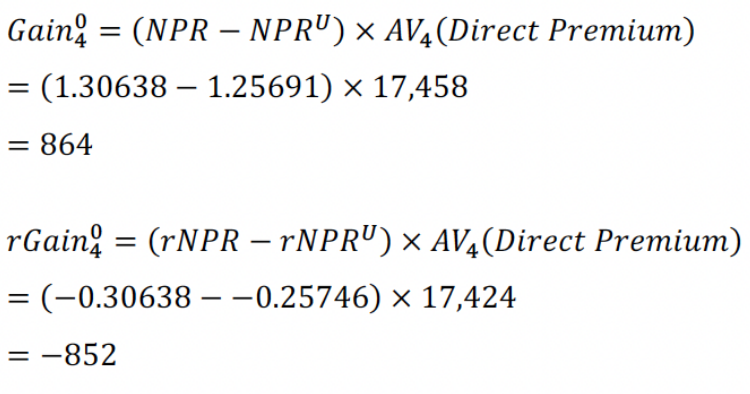

- Updated net premium ratio:

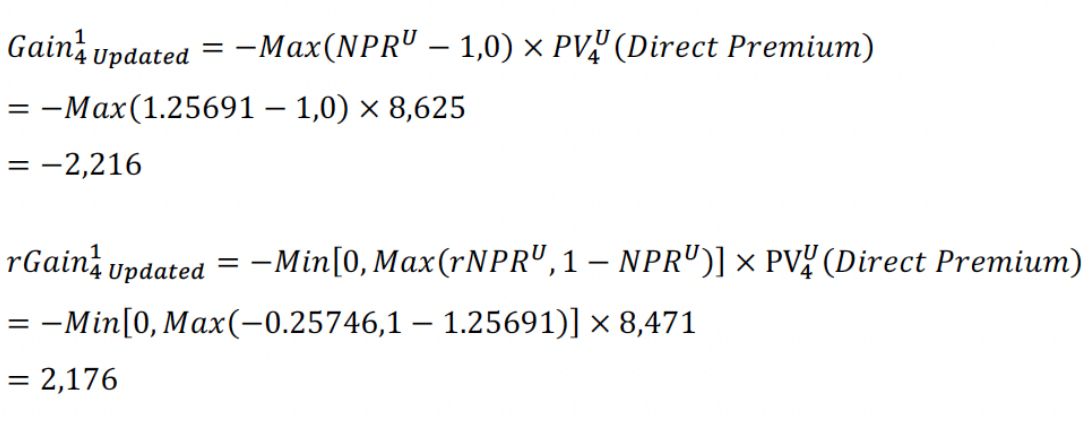

- Effect of capping the new ratio:

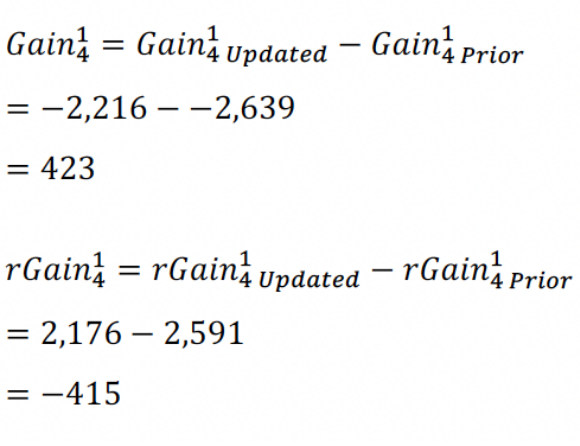

For the current effects of capping, subtract (a) from (c).

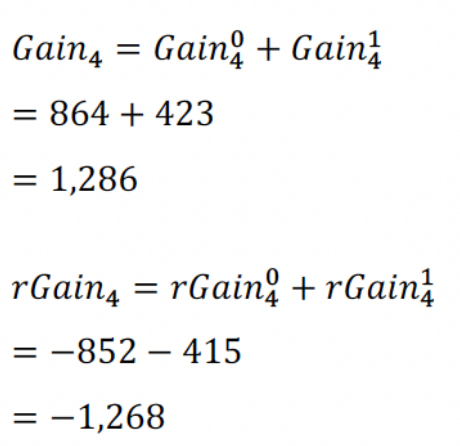

As a check, the sum of the attributed gains should equal the +1,286 and -1,268 gains measured above.

Conclusions

As seen in the illustration, the “Ceded Constraints” framework produces reinsurance gains/(losses) that substantially offset direct (losses)/gains from LFPB constraints. Due to the different discount rates, the offset is not perfect. When both balances are updated for current discount rates, the effects on the balance sheet should be closer, but will still be imperfect due to the different discount rates used in updating the net premium ratios.

Had we calculated AR using the constrained reserve balance (RR instead of uRR), rGain in the fifth year would have been -850, much smaller than the +1,286 direct Gain despite full coinsurance, failing the performance objective. Given space limitations, we do not show derivation of this amount. To fully appreciate this effect, we encourage the reader to verify the difference using the formulas and values presented here, except for substitution of RR for uRR in the calculation of AR.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the authors’ employer.

Steve Malerich, FSA, MAAA, is a director at PwC. He can be reached at steven.malerich@pwc.com.

Jack Liu, FSA, MAAA, is a senior manager at PwC. He can be reached at rongjia.liu@pwc.com.

Endnotes

[1] “Accounting for Ceded Reinsurance Under LDTI—Constraints” by Malerich, The Financial Reporter, July 2022.

[2] “Accounting for Ceded Reinsurance Under LDTI—Existing Business” by Malerich, The Financial Reporter, July 2021.

[3] “Accounting for Ceded Reinsurance Under LDTI—A Fresh Look” by Malerich, The Financial Reporter, November 2020.

[4] “Accounting for Ceded Reinsurance Under LDTI—Precedent” by Malerich, The Financial Reporter, February 2021.

[5] American Institute of Certified Public Accounts, Audit and Accounting Guide - Life and Health Insurance Entities, Appendix A, paragraph A.87.