Did COVID-19 Change Retirement Risks?

By Anna Rappaport

Retirement Section News, September 2022

Americans face a wide range of risks as they plan for retirement. Understanding and identifying the risks and how the public views them have been important components of the Society of Actuaries Research Institute's Aging and Retirement Research. The SOA has identified the risks and strategies for managing them in a publication, “Managing Post-Retirement Risks.” The fourth version of this was published in 2021. The SOA has also studied the public’s perceptions of risk in a series of biennial Risk Surveys and the 11th of these surveys was completed recently. In 2020, COVID-19 changed the everyday life of all Americans. In most areas, non-essential workers were told to stay at home for a period of weeks in order to prevent the spread of the virus. Unemployment increased from under 4 percent to over 14 percent in one month (April 2020) and is now back down to less than 4 percent. There was significant volatility in investment markets and major government monetary assistance was made available to help businesses and individuals manage through the crisis. Markets did well through the end of 2021, but have slowed in 2022. Businesses could have their workers do their jobs from home. Most non-essential businesses were forced to shut down on a temporary basis, and some did not survive.[1]

Retirement risks were present long before COVID-19, but COVID-19 changed the overall risk picture, and increased attention paid to some of those risks. Our knowledge about the impact of COVID-19 is evolving. To provide insights about where we are in 2022 and what the future might look like, I review in this article some key findings from the most recent Risk Survey, retirement risks overall, and what we have learned about the impact of COVID-19.

While the risks previously identified in our surveys did not change significantly during COVID-19, new ones appeared, and the attention of many people shifted to survival and coping with a new environment. COVID-19 impacted the individual, the entire retirement system, including Social Security and government benefits, and the workplace and employee benefits. The 2021 Risk Survey indicated that retirees were less concerned about longer-term post-retirement risks than in 2019 and prior years. This drop in concerns since 2019 seemed quite large and was a major finding of the 2021 study. There was one exception to these general changes, which was the increase in concern about being the victim of fraud. Pre-retirees, however, showed little change in risk concerns between 2019 and 2021. Note the survey was conducted before the recent surge in inflation so concerns about inflation are very likely to have increased.

In 2020, the Society of Actuaries released a new version of Managing Post-Retirement Risks, its “Post-Retirement Risk Chart” and several reports on retirement risk and COVID-19. In addition to the survey, these reports inform this discussion. COVID-19 issues related to the workplace affect how and where jobs are done, which workers are furloughed or laid off, how and when employees retire, the funding and operation of defined benefit (DB) and defined contribution (DC) plans, and emphasize the need for employees to maintain emergency funds. In addition, COVID-19 issues may affect individuals’ retirement security, support and caregiving, access to caregiving, and the ability to work in retirement.

|

Accessing Society of Actuaries reports: All of the Society of Actuaries reports can be found in the Research Section of the Society of Actuaries webpage, under Aging and Post-Retirement or COVID-19. |

The 2021 Risk Survey and the Changing Environment for Retirement Planning

2021 was an unusual year. It is unclear to what extent the 2021 Risk Survey findings reflect longer-term trends or the situation at the moment. COVID-19 changed the current environment for retirement planning. It should be kept in mind that there were big disparities in how different people fared as a result of the pandemic. The largest number of respondents said it did not affect them financially, and more said they were affected negatively than positively. Note also that the pandemic outlook seemed to change from month to month. The field work for the 2021 post-retirement Risk Survey was completed in June 2021. That was before the Delta and Omicron surges and after vaccines had become widely available, and before the higher rates of inflation and the war in Ukraine experienced in 2022. There was substantial optimism at the time about the outlook for the pandemic followed by a lot more uncertainty with additional surges, growth in the number of deaths and people who seemed to have longer-term health issues after an initial period of infection. There remains uncertainty about future surges and the impact of longer-term health issues.

It is unclear how the last two years will affect the economy in the long run. Unemployment is no longer viewed as a problem, and the vast majority of the people who were temporarily laid off have returned to work, but some businesses have failed and some of the people negatively financially impacted by the pandemic will have longer-term problems. After a significant run up, the stock market has experienced a decline. Supply chains were disrupted. After all of these factors and significant government spending in an effort to respond to the pandemic and its impact on the economy, inflation has spiked. After a long period when interest rates were maintained at very low levels by government policy, in an effort to curb inflation, the U.S. Federal Reserve has increased interest rates and may increase them again in the near future.

Some key points about the U.S. retirement environment that existed before COVID-19 include the aging population, growing income inequality, a recognition of disparities by race and ethnicity, the prevalence of the “gig” economy, government policy that maintained interest rates at a low level for a long time, and a major shift of risk from the employer to the individual. The long-term risk shift is in part due to the move away from DB plans so that most active private sector employee benefit retirement programs are DC plans. There has also been a major decline in employer-sponsored retiree medical plans. Much of the long-term risk shift occurred during the period since the Risk Survey series started. It is interesting that the risk shift has not been accompanied by increasing individual concerns about the management of post-retirement risks.

There were persistent low interest rates on bank accounts and bond returns until early 2022, due in part to fiscal policy. These low rates also meant low rates on mortgage loans, but not low rates of interest on credit cards or payday loans. Since early 2022, at the time of this writing, the Federal reserve has increased interest rates three times and they will likely increase more. These rate increases are reflected in increases in mortgage loan and other rates.

Concerns About Various Risks

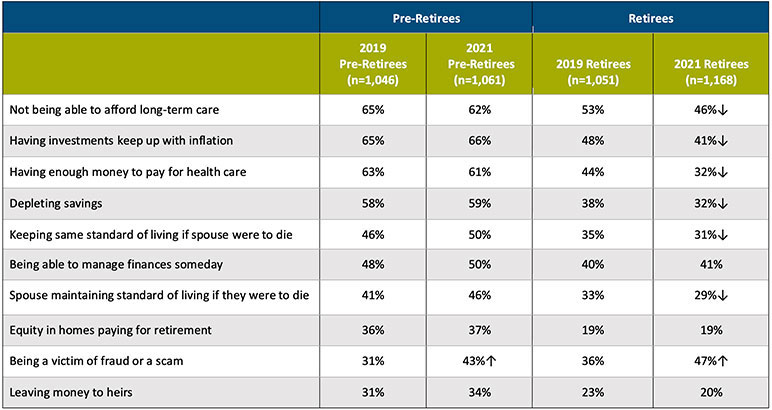

While not addressing all of the economic and retirement environment issues, the 2021 Retirement Risk study helps to quantify the level of concern that retirees have regarding various risks. In general, the current study shows that while a significant minority of retirees have at least some concern about various risks that could affect them, the level of concern they have is clearly lower than those approaching retirement. Similar findings have been found in all of the risk surveys. The only exception to this is concern about fraud, which is higher among retirees. Key findings are shown here and detailed data tables are in the report for the 2021 Risk Survey.

Table 1

Retirement Concerns—2019 Versus 2021 Pre-Retirees and Retirees

Percent Very or Somewhat Concerned

↑ Significantly higher than 2019 ↓ Significantly lower than 2019

Retiree concerns about risk drop: The current data also shows that the level of concern that retirees had in 2021 was lower than it was in 2019, with the exception of concern about fraud, which went up considerably from 2019 to 2021. Levels of concern for retirees are lower than they have ever been. Among pre-retirees, we do not see the same decline. Two areas of particular interest were dropping concerns about being able to afford health care and long-term care. The percentage of retirees who were somewhat or very concerned about being able to afford health care dropped from 44 percent to 32 percent and concerns about being able to afford long-term care dropped from 53 percent to 46 percent. The percentage of retirees concerned being a victim of a fraud or scam increased from 36 percent in 2019 to 47 percent in 2021. Considering the major health challenges of the last two years, these results are puzzling.

Differences in concern levels between pre-retirees and retirees increased: Pre-retirees have consistently been more concerned about risks than retirees, but the difference increased in the most recent survey. In 2021, the percentage concerned about health care is 61 percent for pre-retirees and 32 percent for retirees, for a difference of 29 percent. This is an increase from a 19 percent difference between the two groups in 2019. Increases are found for a range of risks except for fraud. There is some logic in the difference increasing since pre-retirees were more likely to be negatively impacted financially by the pandemic.

Why did these changes happen and what do they mean: The survey does not tell us why the changes happened. The history of the survey series seems to imply that respondents react to immediate conditions, and that within a year or two, they seem less influenced by recent conditions. It is reasonable that people who were not adversely affected financially or in another major way may not be more concerned. Pre-retirees were more likely to be affected, as they had jobs that were often affected. People who had significant investments in equities also benefited from increases in stock prices later on during the pandemic. One possible explanation is that the pandemic shifted people’s attention away from longer-term issues including retirement. Another possibility is that people are very influenced by short-term cash flows and many people were spending less. It is my view that the 2021 retiree risk concerns reflect that people were reacting to an unusual year, and that it should not create expectations for the future.

Most important risks: During most of the 11 post-retirement risk surveys, the top risk concerns were inflation, concerns about paying for health care and concerns about paying for long-term care. In 2021, the top three risks for pre-retirees were inflation with 66 percent very or somewhat concerned, 62 percent for not being able to afford long-term care, and 61 percent for not being able to afford health care. For retirees, the top risks had shifted with fraud at 47 percent being the top risk, and not being able to afford long-term care at 46 percent.

Concerns about fraud: Retirees were more concerned about fraud than pre-retirees. The concerns about fraud increased from the prior surveys. Some of the project oversight group members were concerned in prior years that there was not more recognition of the challenge of fraud. The events of the last two years encouraged additional frauds and a lot of publicity about them. In addition, the isolation of retirees due to COVID increased their risk of becoming fraud victims. Fraud can take many forms, including cyber fraud, telephone fraud, mail fraud and family members or friends as well as caregivers misappropriating or misusing funds. Fraud is often not reported, and it is difficult to find accurate data about its incidence.

Differences in concern and survey results by economic status, including income level: One of the key findings of this study is that the level of concern about various risks varies dramatically by income among both pre-retirees and retirees. In particular, retiree households with over $75,000 in annual income have far lower concerns about various issues such as retaining their assets and paying for health and long-term care. Differences by income level have been found in prior years. Survey results vary by income level, but not for all questions. Detailed findings can be found in the survey report.

Retirement risks, race, and ethnicity: 2021 was the first time the SOA identified race and ethnicity demographics in the Risk Survey. From an economic perspective, Whites and Asian Americans are generally better off than Black/African Americans and Hispanics/Latinos.[2] However, there does not seem to be a consistent difference in retirement risk concerns by race or ethnicity. Future research will be helpful to understand more about the differences by group in thinking about retirement. Some of the questions to think about include: Do some groups tend to think longer term? Are there more multi-generational families in some groups?[3] Are there cultural differences in financial priorities? And, is there more family assistance needed/expected in some groups?

Awareness And Perceptions About Future Financial Events

The 2021 Risk Survey asked pre-retirees and retirees about their preparation for future financial events: The majority indicated that they are well prepared. Seventy percent of pre-retirees and 83 percent of retirees said that they were somewhat or very prepared to handle future financial events. This seems inconsistent with the findings of prior Society of Actuaries research that shows that many people have short planning horizons and retirees have said that they will deal with unexpected expenses when they happen. It is not surprising that responses indicate a sense of optimism. It is fairly common for people to expect that things will be better than they currently are. For example, when asked about levels of performance, few people say they perform poorly.

When perceptions about preparation for future financial events are reviewed by income level, there are huge differences. These differences are greater than the differences in risk perception by income level.

Overview of the Risks and Their Relationship to the Risk Survey

Types of Retirement Risks Faced by Individuals

As mentioned above, there is a wide range of retirement risks faced by pre-retirees and retirees. Employers play a major risk in financial security of Americans and address some of these risks financially in their benefit plans. Others may be addressed through education, counseling, and support services provided as part of financial wellness programs. Many people, however, are simply on their own. The SOA publication Managing Post-Retirement Risks: Strategies for a Secure Retirement[4] and SOA Managing Retirement Decision Briefs[5] linked to specific issues are suitable for distribution to employees[6] and the public. The SOA Risk Surveys offer insights into what people understand and think about risks and how they address these risks. These other publications offer a broad long-term view about the risks and show a more complete discussion of risks than what is in the Risk Survey. Note that some of the risks are unlikely to be well understood by most of the public. The Risk Surveys focus on a subset of the total risks, but offer a pretty good picture of public understanding when the work is considered over a long period of time.

Managing Post-Retirement Risks is in its fourth edition, published in 2021. In the fourth edition, risks are classified into three groups: Economic risks, personal planning considerations, and unexpected (or unpredictable) events. The economic risks include inflation, interest rate risk, financial market risk, and business continuity. Table 2 provides an overview of the economic risks with suggestions as to how individuals can manage them. The suggestions in these tables also can help in the structure of employee benefits and financial wellness programs.

Table 2

Economic Risks

| Risk |

What it Means and COVID-19 Issues |

How to Manage—Individual Perspective |

|

Inflation Concerns about inflation have been in the top group of concerns by retirees and pre-retirees for most of the surveys. In 2021, retiree concerns dropped from 2019 and pre-retiree concerns were level for this risk. |

Retirees, especially those living on a fixed income, need to be concerned about increasing costs in retirement. Current Issues: After several years of artificially low inflation, heavily influenced by government policy, inflation has been on the increase since the fall of 2021. As of June 2022, inflation is at 8.6 percent per year, up from 7 percent at the end of 2021, 1.4 percent at the end of 2020, and 2.3 percent at the end of 2019.[7] Some of the influences on current inflation include government payments during the COVID-19 pandemic not balanced by plans for repayment, higher wages partly driven by employment shortages, supply chain issues partially driven by the global pandemic, and since the first quarter of 2022, the global impact of the Russian invasion of Ukraine and related sanctions and actions. |

Retirees need to plan for inflation and optimize income sources that include cost-of-living adjustments (e.g., Social Security). They also need to consider how inflation will affect future spending and their investments. After several years of artificially low inflation due to public policy keeping interest rates low, other forces have increased inflation rates, and they are currently much higher. |

|

Interest rates There is no specific risk survey question on this risk. It is related to inflation. |

Interest rates determine payouts on savings accounts, CDs, and bonds, and also affect the price of annuities and bonds, and the cost of mortgages and debt. COVID-19 Issues: Interest rates have been very low and part of the response to COVID-19 kept them at a low level for quite a long period. The Federal Reserve is now raising the rates and attempting to control inflation without generating too much slowdown in hiring or the economy. In addition to affecting the return that retirees can earn on their money, low interest rates raise the liabilities for defined benefit plans while reducing the expected return on assets. That increases the amount needed to fund benefits. |

Select investments that meet needs for fixed returns, and that have a time horizon that fits personal needs. Most fixed annuities lock-in current interest rates and they can match needed time horizons. Avoid debt with high interest rates. There is a lot of uncertainty about future interest rates. They are heavily influenced by public policy. As of June 2022, the Federal Reserve had increased rates three times for a total increase year-to-date of 1.5 percent. Significant additional increases are expected in 2022. Thirty-year fixed mortgage rates are 5.70 percent in June 2022, up from 3.11 percent at year-end 2021, 2.67 percent at year-end 2020, 3.74 percent at year-end 2019 and 4.55 percent at year-end 2018.[8] |

|

Financial Markets There is no specific risk survey question on this risk. |

Stock and bond prices vary depending on how well a specific company, the economy, and the industry are doing. Note that there have been four major periods of decline and fluctuation in equity markets in the last 40 years. COVID-19 and other current issues: There were major declines in equity markets in March 2020 followed by partial recovery and fluctuating market conditions. Equity markets are highly uncertain and volatile. The S & P 500 was up 16 percent in 2020 and 27 percent in 2021. It has declined by 20 percent in the first six months of 2022.[9] This affects the assets held in both DB and DC plans. Reduced DB assets can increase the contributions needed to fund benefits. |

It is important to use a diversified investment strategy, taking advantage of stocks and bonds as part of the portfolio, but do not invest too much in any one stock or bond. Financial products and DC plans provide access to pooled investments that include a variety of mixes. |

|

Business Continuity There is no specific risk survey question on this risk. |

Risk of insolvency, bad business conditions, and/or bankruptcy can lead to loss of some pension and annuity benefits. COVID-19 Issues: Some organizations may go into bankruptcy and some bankruptcies have been announced as early as mid-year 2020. |

Consider benefit guarantees and be aware of what is secure and what is not. Remember that businesses such as insurance companies and retirement communities can go bankrupt. Arrangements with insurance companies, banks and mutual funds may be subject to specific guarantees. Remember that investing in the stock of the company that an individual works for creates a double business risk. |

Personal planning considerations include longevity risk, which is the possibility of living longer than expected, risks related to post-retirement employment, changes in housing needs, and changes in marital or partnership status. These risks are a reminder that it is very important for couples to have a plan that works for them both as a couple, as well as for the survivor when they are no longer a couple. Table 3 provides an overview of these risks.

Table 3

Risks and Personal Planning Considerations

| Risk |

What it Means |

How to Manage |

|

Longevity The Risk Survey examines this issue. Concerns about depleting savings are generally not in the top three but are very important. Results vary greatly by income level, which makes sense. A related issue discussed below is how a surviving spouse or partner will do after the first spouse or partner dies. |

Longevity means living a long life and it increases the chance of running out of adequate resources. Retirement planning requires having assets and a flow of income to last through retirement. The first challenge is that many people do not plan for the long term and if they do, they may underestimate longevity. COVID-19 Issues: It is too early to know whether COVID-19 will have any lasting effect on longevity risk. Life expectancies went down a little during the pandemic. |

Couples need to focus on the longevity of the second to die. Social Security claiming decisions and retirement age decisions are a first step in focusing on longevity risk. Managing assets after retirement is also critical. Converting retirement savings into guaranteed monthly income—called "annuitizing"—can address longevity. The complexity comes in the details, such as how much, when, at what cost, and what type of annuity best fits your needs. Systematic withdrawals, often adjusted to reflect remaining life expectancy, provide a varying stream of income. DB plans address this risk. Some DC plans offer options for post-retirement income that address this risk. There are a variety of financial products that address this risk. |

|

Post-retirement SOA research has consistently shown that pre-retirees expect to retire three to four years later than retirees actually retired. The research has also shown that many more people say they would like to work during retirement than actually do. The survey does not directly recognize gaps in knowledge about the potential for employment but the SOA has done additional work on this topic. |

Increasingly, full or part-time employment is desired as part of retirement, because of personal preferences and/or financial needs. COVID-19 Issues: More employees may find post-retirement employment important because of job problems before expected retirement age, earlier than expected retirement and asset losses early in the pandemic. Many people chose to retire earlier during COVID-19 but some have returned to work. Later in the pandemic, workforce shortages emerged. It is unclear to what extent they will lead to improved opportunities for older workers. During COVID-19, there were many changes in how people work, with a move to more remote work and hybrid ranges seeming likely for the longer term. |

Being realistic and flexible is part of what can make this work. Job availability is linked to emerging skills, and the individual should plan to keep or acquire the skills required for ongoing employment. COVID-19 changes led to many more people working from home. This may make some types of post-retirement employment easier to achieve. Older individuals who are flexible and savvy with regard to new skills are much more likely to be able to take advantage of opportunities. |

|

Changes in Housing and Support Needs This was not a focus of the 2021 Risk Survey but it was a special topic in an earlier survey. This topic is related to long-term care and concerns about long term care are consistently a top risk. |

Housing needs may change in the future when functional status changes and caregiving help is needed. Housing is also the largest item of retiree expense, and there are wide variations in cost by location, type of housing, and support services; if any. COVID-19 Issues: Many people may re-evaluate whether senior communities that include assistance and communal meals are a better fit for them after COVID-19. There were pros and cons of senior communities during COVID-19. Some nursing homes had very bad COVID-19 experience and others did not. Families were unable to visit their loved ones and many of them died in isolation. COVID-19 was very difficult both for people in senior communities and those people in their own homes or living with their families. COVID-19 raises new considerations in the choice of housing options. I have been in contact with a number of people who experienced COVID-19 in senior housing, in an age friendly gated community, and in their own homes in a city environment. People generally found the isolation period difficult, regardless of their setting. The experience in the senior communities varied a lot, but most of the people felt they were better off than if they were alone in an apartment somewhere. This would be particularly true for solo agers. Most of the community residents stayed in touch at least using phones and Facetime, walked together, had food delivered to them regularly, and did not lose their sense of community. In one community, activities and exercise classes were continued by putting them on in-house TV networks. In another situation, the isolation from family was viewed as unbearable and the individual left the community. I believe that more families made such decisions. Based on the anecdotes I heard, there were huge differences in management communication with residents as well as success in managing the difficult period. People in their own homes without family or friends nearby were often in a most difficult situation, particularly if they were not linked to others by Zoom and other electronic means. Access to medical care was difficult and sometimes impossible during COVID-19. While telehealth filled some of the gap, some people had difficulties because they were unable to get needed surgeries and other medical care for long periods. |

Housing decisions are important to happiness and determine access to family support, social opportunities, health care and daily living care. Age friendly communities offer more resources and choices to individuals as they age. The Village movement organizations offers people who are in their homes access to some resources and to other seniors in their area. Senior housing (especially housing offering a variety of care choices) can offer a very good lifestyle choice for people who have some limitations and want access to a lot of activities and a good community. My view today is that different choices fit well for different people and it is important to look at the choice considering the access to the people, medical care, and activities that an individual wants. The evaluation should also include some consideration of back-up for systems that may not work in times of intense need or if people move, etc. Living arrangements also define access to some types of care and support including medical care and other forms of support. Some households who have caregivers and other support were unable to get their support during the pandemic or lost it due to illness creating very difficult situations. My view is that pandemic will focus some people on the disadvantages of living alone without access to family and/or friends or a support network. There may be more multi-generational households after COVID-19 or people choosing to live with others. There also may be more people choosing to focus on senior communities and/or other age friendly communities. |

|

Death of a spouse or partner The standard of living of the spouse or partner after the other one dies is an important topic in the Risk Survey. Pre-retiree concerns on this topic rose moderately from 2019 to 2021, while retiree concerns dropped a little. |

The death a spouse or partner can cause drastic changes in retirement plans. Roles in handling finances may also change. Lifestyle needs (housing, companionship, and care) will also be altered. |

Society of Actuaries research indicates a wide range of situations exist for the survivor. Often the survivor experiences a decrease in income more than expenses and reduced assets due to care of the deceased. Many survivors are worse off financially. Employee benefits help in addressing this risk. Life insurance and structuring of payment options for benefits are important elements in risk management. Long-term care insurance can also help protect the assets of the survivor when the individual who is deceased had a long period of illness. A support system is also important for the survivor. |

|

Divorce or separation from spouse or partner This is not covered in the 2021 Risk Survey. In earlier work on shocks, one of the shocks that individuals could often not recover from was divorce after retirement. |

Divorce or separation after retirement has financial and emotional consequences for retirees. Lifestyle needs (housing, companionship, and care) will also be altered. |

Divorce after retirement splits financial resources, including retirement accumulations; this can be a dramatic shock. Many retirees have difficulty fully recovering from a divorce after retirement and some from a divorce at any age. |

Unexpected (or unpredictable) events include public policy changes such as changes in taxes and government benefits, significant health care needs, unforeseen needs of family members, and bad advice, fraud, or theft. Table 4 provides an overview of these risks.

Table 4

Unexpected and Unpredictable Events

| Risk |

What it Means |

How to Manage |

|

Public policy changes This is not covered in the 2021 Risk Survey. |

Changes in taxation, public benefits, and rules governing private benefits can improve or worsen the situation of retirees. COVID-19 Issues: Federal programs to help the economy during COVID-19 were very costly and may lead to an interest in reducing other spending. COVID-19 resulted in declines in tax revenue and increases in expenditures in some states and local areas, with the possibility that public benefits such as Medicaid may be cut. Social Security and Medicare needed more funding before COVID-19 and that will be more difficult after COVID-19. There is a lot of uncertainty around government programs. |

Maintain a cushion and lock-in some steady income. Public policy risk is not personally manageable or predictable. However, investing outside of the home country is a way to protect against some forms of public policy risk. For example, many Latin Americans buy housing in Florida and Chinese have bought housing in Canada as a way to protect against public policy risk. |

|

Significant health care needs Concerns about paying for health care has been one of the three top risks in the survey series. In 2021, it remains a major risk for pre-retirees, but there is a significant drop in concern about this risk by retirees. |

Some people need large amounts of health care in retirement and may not have planned adequately for it. Some people need ongoing support with a variety of tasks. COVID-19 Issues: COVID-19 made it clear that there is a lot of inequality in health care, there are many people who are uninsured, and others with high deductibles. It also made clear how important it is for all of society that everyone who was affected could get care. During the worst parts of the pandemic, elective surgery and routine medical care was often not available, and some visits were handled with tele-health. People needing care might not have been able to get it where they normally would. After doctors’ offices reopened, many people were still reluctant to visit these offices to seek care. |

Take care of yourself to improve health and reduce the risk. Choose health insurance approaches wisely. Note that Medicare-eligible individuals have annual decisions to make and that there are major differences between options, and these differences can change year by year. Care is needed in paying attention when selecting plans that have networks. Networks can change, and there can be difficulties in getting specialty care—either long waits or the need to travel to get the care. Options are based on the local market. Options and decisions are different for people who have access to employer-sponsored coverage. COVID-19 created challenges in getting both care for COVID-19 and other care during the pandemic. It likely increased the challenges of getting care within networks in some cases. When plans with networks are chosen, it is advisable to be careful and think through the issues related to the network and its availability. |

|

Unforeseen needs of family members The 2021 Risk Survey included some questions about multi-generational families and the expected role of family in providing help if needed. |

Family members, often adult children, need help and retirees may step up to help them. COVID-19 Issues: COVID-19 has created many challenges for family members including those caring for older family members. Family members have been unable to visit people in nursing homes or other senior residence facilities, even if they are helping them or serve as advocates for them. It has been stressful for all concerned. |

This is often an overlooked area of planning. If individuals plan to help family members, then they can include such expenses in retirement planning and determine if they can afford to help them. A short-term planning horizon may leave retirees vulnerable to making mistakes and using too much of their assets to help family members. In the future, more people may choose to live in multi-generational households. |

|

Bad advice, fraud or theft The 2021 Risk Survey showed a major increase in concern about fraud. |

Fraudsters are everywhere, and seniors can be especially vulnerable. The perpetrators of fraud can be strangers or people we know. Individuals who have experienced cognitive decline are more vulnerable. COVID-19 Issues: New frauds have been identified linked to COVID-19 issues and special payments. |

Care is needed when households ask for advice and hire help who will be in the home. In some cases, family members, trusted advisors or even court-appointed guardians can be sources of exploitation. Some help is bonded and some is not. Sources of help should be vetted. Use bonded caregivers. If a family member takes over day-to-day money management, encourage the use of some checks and balances so that information is shared. Care should be taken to designate a strategy for health care and financial decisions after one is no longer able to perform those functions. Financial wellness programs may include education on this topic. |

|

Note regarding disability: Tables 1, 2, and 3 describe post-retirement risks. Some also apply to pre-retirement. Disability is a major risk pre-retirement that is not included in these tables. Coverage for this risk is an important part of building retirement security. |

Persistent Retirement Risk Findings from SOA Consumer Research Inform Planning

The SOA has conducted biennial risk surveys since 2001 and several sets of focus groups with retirees at different stages of retirement. The first set of focus groups was with recent retirees, and this was followed up with focus groups with people retired 15 years or more, as well as research with people age 85 and over. The risks surveys included pre-retirees and retirees and was targeted to be economically representative of the U.S. population. The focus groups and over age 85 research group were designed to represent people who are asset-limited and they do not include any higher net-worth individuals.

Repeated findings indicate some consistency in risk concerns, most often used risk-management strategies, and knowledge gaps. A few of the findings that are important include:

- There are many gaps in knowledge. The respondents were not generally knowledgeable about longer-term retirement planning and retirement risks, and when they were, they do not necessarily act. Gaps in knowledge appear in the 2021 Risk Survey as well as prior surveys.

- Three top post-retirement risk concerns persist. These are inflation, health care expenses, and paying for long-term care. These concerns have been found consistently over repeated iterations of the survey through 2019; however, the ranking among these concerns has changed over time. They remain among top concerns in 2021 but there has been some change in top concerns. One of the puzzling questions is why there is not more concern about long-term care. Almost everyone is insured for acute health care expenses once they reach Medicare eligibility, but only about 10 percent of the population has long-term care insurance.

- Some risks may be overlooked. In the past, retirees and pre-retirees seem to have relatively little concern about some important risks such as fraud, exploitation, and theft of assets. Awareness and concern has increased in the 2021 Risk Survey.

- People often retire sooner than they expect. In 2021, the median actual retirement age was 61 compared to an expected retirement age of 65. Similar results, but with a larger difference, have been found survey by survey. The SOA 2013 focus groups indicate that most people were pushed or forced into retirement earlier than planned due to their job situation or due to their own or other family member’s health, and the 2019 survey tends to confirm that. Advisors can help clients determine when they want to retire, in addition to helping them implement a “Plan B” if they are pushed into retirement earlier than expected.

Conclusions and Looking Forward

The risk surveys and other risk management research from the SOA have been summarized in a series of reports, each focusing on a theme rather than a specific research project. Each brings together work from several reports. The survey-to-survey changes in the Risk Survey results reflect a balance between response to immediate conditions and trends around longer-term stability.

The 2021 survey showed a decline in risk concerns on the part of retirees, even though many Americans died and nearly everyone had their lives disrupted by the pandemic. But economically, the vast majority of the population got some government relief linked to the pandemic, and while the stock market was very volatile, it went up during much of the pandemic. Income reductions and financial distress were experienced by many people, but the impacts were very unevenly spread. Some people had increases in income and most people spent less. By late in 2021 there were substantial labor shortages, particularly in some occupations, as well as emerging inflation and many supply chain problems. In 2022, the inflation worsened and the Ukraine war had an impact on the U.S. economy as well as the global economic system. The U.S. stock market just experienced its worst overall investment start to the year since 1970.

During the pandemic there were major temporary changes in the way we work and it looks like new patterns of work are emerging that will remain longer term. There have been long-term changes in technology and the way that organizations adopt changes. It is unclear how benefits and compensation will respond to the emerging environment, but it seems clear to me that more change is very likely.

With the major shifts in inflation levels between 2020 and 2022, it also seems likely that many retirees who managed quite well without large retirement assets may have a lot more challenges. Managing spending was a major method of expense management for many retirees, but those who have already cut expenses will not find an easy route to further cuts. Some will face difficult situations. I expect that there may be major shifts in risk perceptions over the next couple of years.

For future retirees, working longer and working in retirement on a modified basis is a major method of dealing with economic challenges. I hope to see the U.S. finally deal more with societal aging and its impact on retirement. Failure to deal more broadly with the issues of societal aging creates long-term challenges for individuals, for not-for-profits, for business and for society as a whole, both in the U.S. and in other countries.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Anna Rappaport, FSA, serves as chairperson of the Committee on Post-Retirement Needs and Risks. She can be reached at anna.rappaport@gmail.com.